Trump’s Tariff Turmoil

James Carville, the political advisor who coined the phrase ‘it’s the economy stupid’ as a campaigning slogan for Democrat Bill Clinton to win the 1992 presidential election, was once asked what he’d like to be […]

James Carville, the political advisor who coined the phrase ‘it’s the economy stupid’ as a campaigning slogan for Democrat Bill Clinton to win the 1992 presidential election, was once asked what he’d like to be […]

Trump’s 2nd April “Liberation Day” speech was a turning point, as it launched an open offensive to break capitalist globalisation in its current form. This was not, as Trump falsely claims, in the interests of US […]

by Tony Saunois, CWI Secretary in Spotlight on Revolutionary Tactics & Strategy

The election of Donald Trump, a right-wing populist with strong ties to the far-right, has prompted fear of what his agenda could have in store for the working class. Trump ran on an anti-immigrant platform […]

Interview with Clare Bayler, from Independent Socialist Group. Donald Trump is being inaugurated on 20 January. Lots of people in Britain are repulsed by his reactionary rhetoric and find it hard to understand what led […]

“It is time to study Caligula. That most notorious of Roman emperors killed what was left of the republic and centralised authority in himself. Donald Trump does not need to make his horse a senator; […]

If anyone had doubts about the second Donald Trump administration unravelling the so-called ‘world order’, they will have had a sobering experience over the last few weeks. Trump has ditched the normal niceties of international […]

Starmer offers to act as a “bridge” between US and Europe as No trust in Trump, Starmer or any of the capitalist warmongers! Fight for a socialist alternative to capitalism and war! The British prime […]

It is often a paradox of war that as the end begins to loom in the distance, the ground fighting intensifies. With the election of Donald Trump to the White House, the war in Ukraine, […]

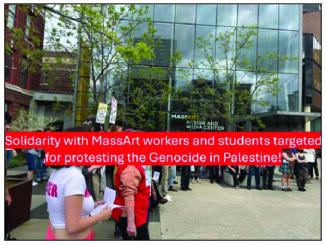

Once again, the people of Gaza are being bombed, shot and starved. Israel has imposed a complete blockade of water, food, electricity, and medical supplies. All humanitarian aid is withheld to Gaza. The World Food […]

Mass protests have erupted across Israel, with over 100,000 people demonstrating in Tel Aviv and other cities on 22 March. Protesters blocked highways, surrounded the Israeli parliament in a makeshift encampment and endured beatings by […]

But how to end siege of Gaza and occupation of all Palestinian territories? Emotions ran high across the world at the news that a ceasefire deal was being agreed for Gaza. But alongside that wave […]

Brutal wars have repeatedly been carried out by Israeli military forces on Gaza since a ruthless blockade was imposed on that strip of land in 2007. Each one brought terrible death and destruction but the […]

A printable version of this article can be downloaded here. The Israeli army is laying waste to Gaza. Whole communities are being destroyed and entire families wiped-out. The scale of displacement, as people are forced […]

The world’s imperialist powers have always intervened in the Middle East for their own political, strategic and economic interests. On the one hand dishing out investment, aid, trade deals and promises of protection, and on […]

But faces huge economic problems and outside powers’ interference Jubilation among big sections of the population of Syria followed the quick demise of the Basha al Assad regime in early December 2024. After twelve years […]

But independent workers’ organisation needed to struggle for socialist democracy Millions of Syrian people reacted with astonishment and joy at news that the Assad family’s five-decade long despotic regime had collapsed. President Bashir al-Assad, and […]

The ceasefire in the Israel–Iran war has brought after twelve days an end, for now, to the aerial bombing offensive that killed hundreds of Iranian civilians, as well as to the counter-offensive in which missile […]

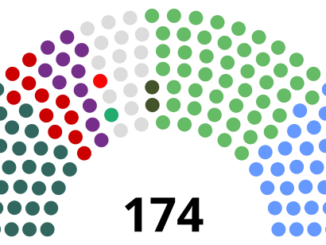

Sri Lanka’s general election, held on 14 November, marked a breaking-point in the country’s political history. The National People’s Power (NPP) secured an extraordinary 159 seats, achieving a two-thirds majority in Parliament. This result shocked […]

For the first time in Sri Lanka’s history, the country finds itself under the leadership of a president—Anura Kumara Dissanayake—who hails from a party with a left-leaning background. However, despite the media’s portrayal of him […]

Though the establishment parties somehow survived the Aragalaya (The Struggle) in 2022, they were never able to win back the full trust of the masses. The ruling Rajapaksa family then stepped back from governmental positions […]

The phenomenon of right-wing populism is not new in most countries, but there is much to suggest that it has reached a new level. Not only because in opinion polls and elections the share of […]

The biggest protest in Serbian history happened on 15th March in the capital Belgrade. The upper estimate is 800,000 people; the entire population of Serbia is less than seven million. It was a culmination of […]

On September 29 in 2024 parliamentary elections took place in Austria. But it was not until March 2025 that a new government was formed. It took three separate negotiating attempts before it could be formed: […]

The Left is the ray of hope against cuts and racism The result of the federal election is a slap in the face of the established, pro-capitalist parties. The only parties that won were those […]

Last week, the Norwegian two party minority coalition government collapsed, according to the Financial Times (London), “over whether Norway should keep more of its electricity for itself to lower prices or export it to the […]

“This is not a Liz Truss moment”, declared a former director of the International Monetary Fund (IMF), referring to the brief period of the Tory prime minister Liz Truss’s time in office, as the pound […]

Following the Dáil [parliament of the Irish republic] elections of 29 November, government formation talks continue. While there is no doubt that the two main traditional ruling parties of Irish capitalism, Fianna Fáil and Fine […]

It is no news that the former governor of Lagos State, Bola Ahmed Tinubu of the All Progressives Congress (APC), has been declared the winner of the presidential election held on Saturday, February 25, 2023. […]

When Strikes and protests nearly swept a capitalist regime out of power Ten years ago, instead of the festivities that often herald the New Year, Nigerian working people and youth started the year 2012 at […]

Nigeria has passed through nearly a month of turmoil. Video footage of the hated SARS police unit killing a man and driving off in his car was the spark for mass protests. Years of frustration, […]

On March 28th, a 7.7-magnitude earthquake struck Myanmar. The epicenter was located in the border area between Sagaing Region and Mandalay, the country’s second-largest city. The earthquake was the strongest to hit Myanmar since 1912. […]

Protests have rocked Mozambique since ‘preliminary’ results of presidential and legislative elections held on 9 October declared the ruling Mozambican Liberation Front (Frelimo) the winner. Mozambique can be added to the growing rollcall of neocolonial […]

The revolutionary mass movement in Bangladesh is at a critical juncture. A 17-member interim government has been established, including in it a few young leaders who emerged from the mass protests which toppled the government. […]

Mass protests in Kenya have forced the government to withdraw unpopular tax increases. These amounted to a massive attack on the living standards of the middle class, the working class, the poor and young people. […]

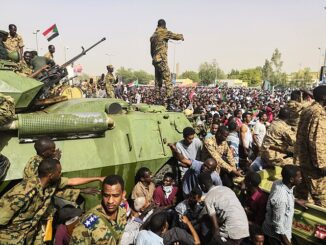

A brutal power struggle is under way in Sudan. On 15 April, heavy fighting erupted between different factions of the armed forces. Civilians have abruptly found themselves in war zones, especially in the capital Khartoum. […]

Friday, October 18, 2019, is marked as the day on which a large-scale revolutionary process began in Chile. A massive mobilization, where millions of young people, workers, women, residents, and social organizations took to the […]

On 27 January, the March 23 Movement, backed by the Rwandan government, announced the capture of the Congolese city of Goma and on 17 February of Bukavu. These cities, both provincial capitals, sit on the […]

Trump is back in the White House. Much of the world is gripped by fear about what his second term will mean, as are millions in America – particularly migrants, LGBTQ+ people, and others likely […]

Originally published in Socialism Today, magazine of the Socialist Party (CWI England & Wales). This year is the thirtieth birthday of the World Trade Organisation (WTO). It is also the year China opened a WTO […]

The new lease of life that world capitalism experienced after the collapse of the Stalinist states of Russia and Eastern Europe from the late 1980s has definitively run its course. Whatever the immediate perspectives are […]

by Karl Simmons, CWI Japan in Japan

by Marxist Workers Party (CWI SA) reporters in South Africa

by Hannah Sell, CWI International Secretariat in Spotlight on China

by B. Youvraj, New Socialist Alternative (CWI India) in India

by David Ellis, Socialist Party (CWI England & Wales) in Climate Change & Environment

by Sosialis Alternatif (CWI Malaysia) reporters in Malaysia

The CWI relies on the donations from working class people around the world to fund our campaigns.Please donate towards building the CWI.

Please Subscribe

It is with great sadness that we announce the passing of Peter Taaffe, who after a long illness died on 23 April 2025. The loss of Peter is a big blow to the working class […]

CWI- Please inform us if you are reproducing any material from this site.